And Why Gold and Silver Are Often Discouraged

This short article explains a simple idea many people feel but can’t quite name:

You can lose money even when no new tax is announced.

Let’s walk through how that happens, why savings accounts are part of the problem, and how IMMachines readers can respond calmly and clearly—without panic.

1. Taxes Are Only the Obvious Way Money Is Taken

Most people think governments take money in one main way:

Taxes

-

income tax

-

VAT / sales tax

-

property tax

These are visible. You see them on payslips and receipts.

But there is a second, quieter method that most people are never taught about.

2. Inflation Is a Hidden Tax

Inflation means prices go up.

But here’s the key point:

If prices rise faster than your savings grow,

you are getting poorer every year.

Example (very simple):

-

You earn 2% interest on savings

-

Real prices rise 5%

-

You lose 3% of your purchasing power

No bill arrives.

No vote happens.

But your money buys less.

This is why inflation is often called a stealth tax.

How Inflation Is Also Used to Hold Wages Down

There’s another way inflation quietly takes money from people — through pay and minimum wage calculations.

Most wages are adjusted using official inflation numbers.

The problem is simple:

-

If real living costs rise faster than the official inflation rate

-

And wages only rise in line with that lower number

Then workers fall behind even when they get a “pay rise.”

Example:

-

Official inflation: 3%

-

Real cost increases (food, energy, rent): 6–8%

-

Wage increase: 3%

On paper, you’re keeping up.

In real life, you’re losing ground.

This creates a quiet effect:

People work more, earn more numbers, but afford less life.

Minimum wage works the same way.

When minimum wage rises based on understated inflation, it:

-

looks generous

-

sounds fair

-

but still lags behind real costs

This is why many people feel like:

-

they’re always “just about managing”

-

no raise ever creates relief

-

progress feels temporary

It’s not because people are lazy or bad with money.

It’s because inflation controls the measuring stick.

And when the measuring stick is bent, every calculation based on it is distorted.

3. Why Official Inflation Numbers Feel “Wrong”

Many people notice this:

“They say inflation is 3–4%, but my food, energy, rent, and insurance are way up.”

That’s because:

-

official inflation baskets are adjusted over time (in the Governments favour)

-

cheaper substitutes are used

-

important costs are downplayed or delayed

The result:

-

official inflation looks smaller

-

real living costs feel bigger

This gap quietly transfers wealth from savers to the system.

4. Low Interest Rates Finish the Job

Now combine inflation with low interest rates on savings.

If:

-

inflation is higher than interest

-

banks pay you less than prices rise

Then keeping money in savings:

-

looks “safe”

-

but slowly drains value

This process has a name:

Financial repression

It means:

People are forced to hold money that quietly loses value

while debt becomes easier for governments to manage.

5. Why Gold and Silver Don’t Fit This System

Gold and silver behave differently from bank money.

They:

-

are not someone else’s debt

-

can’t be printed

-

don’t depend on interest rates

That makes them hard to control.

Because of this, they are often:

-

ignored

-

mocked as “old-fashioned”

-

called “unproductive”

But central banks themselves keep buying gold.

That contradiction tells you something.

As Ray Dalio has openly said, when trust in money and debt weakens, capital looks for a neutral store of value.

Gold and silver do not need permission to exist.

6. Why Physical Assets Are Quietly Discouraged

Physical assets:

-

remove money from the banking system

-

reduce control

-

limit policy options

So the system prefers you to:

-

save digitally

-

stay inside institutions

-

trust official numbers

This doesn’t require a conspiracy.

It’s simply how incentives work.

7. How IMMachines Readers Should Respond (No Panic)

This is not about fear.

It’s about orientation.

Here’s a grounded response:

1. See Clearly

Understand that:

-

savings accounts are not “risk-free”

-

inflation is a transfer of value

-

stability is not guaranteed by default

2. Reduce Blind Trust

Do not assume:

-

official numbers tell the whole truth

-

banks exist to protect your purchasing power

3. Diversify Reality

This doesn’t mean “all-in” on anything.

It means:

-

don’t keep everything in one system

-

understand what you actually own

-

value resilience over yield

4. Stay Human

The biggest risk in financial stress is reactive behaviour.

Clarity beats speed.

Grounding beats guessing.

A Gentle Bridge to the Identity Awakening System (IAS)

When money systems feel unstable, people often rush to do something.

But before action comes orientation.

The Identity Awakening System (IAS) exists to help people:

-

slow down beneath the noise

-

reconnect with their own internal truth

-

act from clarity, not pressure

IAS doesn’t tell you what to buy.

It helps you remember who you are when external systems wobble.

Because decisions made from panic rarely age well.

You can explore IAS quietly here:

👉 https://immachines.groovepages.com/identity/

No urgency.

No promises.

Just clarity.

Final Thought

You are not failing if saving feels pointless.

You are noticing something real.

When systems extract value quietly, awareness becomes protection.

Not fear.

Not rebellion.

Just clarity before action.

I asked AI if there is a possibility that the Government could confiscate gold and silver

1. Yes — Governments Have Confiscated Gold Before

The clearest example is the United States in 1933 under Franklin D. Roosevelt.

What happened (very simply):

-

The US was in the Great Depression

-

Banks were collapsing

-

The dollar was still tied to gold

-

People were hoarding gold and not spending

The government issued Executive Order 6102, which:

-

required citizens to hand in gold

-

paid them a fixed price set by the government

-

imposed fines and jail time for non-compliance

After confiscation, the government revalued gold higher, effectively transferring wealth from citizens to the state.

This was not subtle.

It was emergency power during a systemic collapse.

2. Why That Context Matters

Gold confiscation only made sense because:

-

The currency was gold-backed

-

The government needed gold to support the dollar

-

Most gold was already in banks or visible institutions

-

Capital controls already existed

Those conditions do not fully exist today.

Most modern currencies are fiat — not redeemable for gold.

That changes the incentive.

3. Could It Happen Again in Theory?

In theory: yes

In practice: much harder

For a modern Western government to attempt this, it would require:

-

a declared national emergency

-

legal powers overriding property rights

-

public compliance

-

enforceability

And even then, it would face serious problems.

4. Why Gold & Silver Confiscation Is Harder Today

1. Ownership Is Decentralised

Physical metals are:

-

privately held

-

globally distributed

-

often outside the banking system

Unlike 1933, there is no central registry of who owns what.

2. Enforcement Is Politically Toxic

Confiscating personal property:

-

destroys trust instantly

-

risks social unrest

-

invites legal challenges

Governments know this.

3. Silver Is Especially Impractical

Silver is:

-

bulky

-

widely used in industry

-

already embedded in products

Confiscating silver would disrupt entire supply chains.

5. The More Likely Modern Tactics

Rather than outright confiscation, governments historically prefer indirect pressure.

Examples include:

-

windfall taxes

-

reporting requirements

-

capital controls

-

transaction restrictions

-

discouraging narratives (“unproductive asset”, “speculative”, etc.)

These approaches:

-

achieve partial control

-

avoid mass backlash

-

keep plausible deniability

This is how modern systems usually operate.

6. What About the UK Specifically?

In the UK:

-

private gold ownership is legal

-

there is no current proposal to confiscate metals

-

property rights are stronger than in 1930s America

However:

-

emergency powers do exist

-

capital controls are historically normal in crises

-

trust in institutions is lower than in past decades

So the honest assessment is:

Low probability, high consequence, not zero.

Which means panic is unhelpful — but awareness is wise.

7. The Real Issue Isn’t Gold — It’s Orientation

Here’s the deeper point that often gets missed.

If a government ever reached the stage of confiscating private assets:

-

money systems would already be failing (- I think this is happening now!)

-

social trust would already be broken (- yes this too is happening now!)

-

legal norms would already be stressed (- yes the law is corrupted as Martin Geddes has illustrated)

At that point, no asset choice alone saves you.

What matters more is:

-

adaptability

-

decentralisation

-

clarity

-

personal resilience

That’s why focusing only on “what they might take” misses the bigger picture.

8. A Grounded Response (Not Fear-Based)

A calm, adult response looks like this:

-

avoid single-point dependence

-

understand the difference between ownership and access

-

stay legally compliant

-

keep optionality

-

stay psychologically grounded

And most importantly:

-

don’t outsource your sense of security to any single system

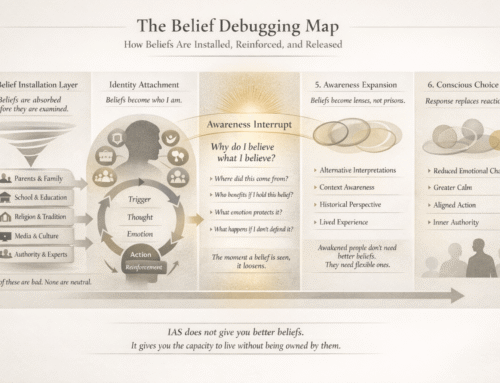

9. Where IAS Quietly Fits Into This

Moments like this reveal something important:

When people feel unsure, they look for certainty outside themselves.

The Identity Awakening System (IAS) exists to reverse that reflex.

Not by predicting outcomes —

but by helping people act from clarity instead of fear, even when systems wobble.

Because history shows:

-

panic creates worse outcomes than preparation

-

forced decisions usually come from disorientation

IAS is not about hiding assets.

It’s about not losing yourself when pressure rises.

You can explore it quietly here:

👉 https://immachines.groovepages.com/identity/

No alarm.

No urgency.

Just orientation.

Final Thought

Governments confiscate assets only when systems are already breaking.

The real protection is not secrecy or speed.

It’s:

-

awareness

-

decentralisation

-

clarity

-

and staying human under pressure

Fear narrows options.

Clarity expands them.

Gold Confiscation (Then) vs CBDCs (Now)

It’s useful to compare how control was exerted in the past versus how it’s more likely to happen today.

1. Method of Control

Gold Confiscation (1930s):

-

Physical seizure of assets

-

Required laws, enforcement, and compliance

-

Highly visible and politically explosive

CBDCs (Central Bank Digital Currencies):

-

Control is embedded in the system itself

-

No seizure needed — access can be restricted

-

Much quieter, more technical, less visible

2. What Gets Controlled

Gold Confiscation:

-

A specific asset (gold)

-

Limited to those who held it

CBDCs:

-

The money itself

-

Potentially everyone using the system

With CBDCs, control can include:

-

where money can be spent

-

when it can be spent

-

whether it can be spent at all

3. Public Resistance

Gold Confiscation:

-

Required mass compliance

-

Created backlash and resentment

-

Politically costly

CBDCs:

-

Introduced gradually

-

Often framed as “convenience” or “efficiency”

-

Resistance tends to come after adoption

4. Why CBDCs Are More Attractive to Governments

From a government perspective:

-

Gold confiscation is blunt and confrontational

-

CBDCs are precise and programmable

That’s why many analysts see CBDCs as a modern replacement for old-style asset control, not an addition to it.

🧭 Why This Matters for the Reader

The risk today isn’t usually someone knocking on your door for your assets.

The bigger risk is:

-

loss of access

-

loss of choice

-

loss of autonomy through systems you didn’t consciously opt into

That’s why holding physical assets has historically been discouraged, mocked, or marginalised:

-

they sit outside programmable systems

-

they can’t be switched off

-

they require personal responsibility

🧠 Bringing It Back to IAS (Quietly)

All of this points to a deeper issue.

When systems become unstable or controlling, the first thing people lose isn’t money —

it’s orientation.

They panic.

They rush.

They outsource decisions.

The Identity Awakening System exists for moments like this — not to predict outcomes, but to help people:

-

think clearly

-

act deliberately

-

avoid fear-based decisions

Because the most dangerous thing in any transition isn’t change.

It’s confusion.

What Should I Actually Do?

You don’t need to predict the future.

You don’t need to overhaul your life overnight.

And you don’t need to agree with every warning you hear.

What does help is responding calmly, deliberately, and proportionally.

Here’s what that looks like in real terms.

1. Reduce Blind Trust — Not Total Trust

It’s reasonable to use banks, systems, and technology.

It’s risky to depend on only one system.

Ask yourself:

-

If this stopped working for a week, would I cope?

-

If access was delayed or restricted, what would I feel — panic or inconvenience?

The goal isn’t fear.

It’s optional redundancy.

2. Hold Some Value Outside Screens

You don’t need to go “all in” on anything.

But having something real, offline, and not permission-based matters:

-

physical assets you can access directly

-

resources you understand without intermediaries

Not because collapse is guaranteed —

but because resilience comes from diversity, not certainty.

3. Don’t Chase Returns — Protect Optionality

When systems wobble, people rush toward:

-

fast profits

-

complex strategies

-

loud promises

That usually ends badly.

A steadier question is:

“Does this increase my choices — or narrow them?”

Optionality beats optimisation in uncertain times.

4. Strengthen the One Thing You Always Carry: Yourself

Systems change.

Rules move.

Markets reset.

But your ability to:

-

think clearly

-

regulate fear

-

decide without urgency

is always portable.

This is where most people skip ahead — and pay later.

5. Pause Before Building Anything New

If you feel pressure to act, build, or decide fast — pause.

Ask:

-

Is this coming from clarity, or anxiety?

-

Am I responding — or reacting?

You don’t need to rush into a new identity, project, investment, or belief system.

You need orientation first.

6. Remember: Calm People Win Transitions

Historically, during periods of change:

-

the loudest voices are rarely the wisest

-

the fastest movers are rarely the most stable

-

the calmest people tend to emerge with the most options

Stability isn’t passivity.

It’s self-trust under pressure.

A Quiet Reframe

You don’t need to “beat the system.”

You just need to:

-

not be crushed by it

-

not be hypnotised by it

-

not outsource your sense of direction to it

That starts long before money decisions.

It starts with clarity.

And clarity always comes before creation, reaction, or commitment.