This post is for IMMachines readers who want clarity, not hype.

You may have seen headlines or videos claiming that “silver failing to deliver will blow up the entire financial system.”

That sounds extreme — so let’s slow it down and explain what is actually being claimed, why people are worried, and what the real consequences could be, in plain, 10th-grade language.

This explanation is based on a recent interview with Bill Holter, a long-time market commentator.

No panic. No predictions. Just understanding.

First: What Is a “Failure to Deliver”?

In financial markets, especially commodities like silver, most trading happens on paper contracts.

These contracts promise:

“I will deliver silver later at an agreed price.”

But here’s the key detail:

👉 Most of these contracts are never settled with real metal.

They are usually rolled over, closed out, or settled in cash.

That system only works if everyone believes delivery could happen if needed.

A failure to deliver means:

-

Someone asks for real silver

-

The seller does not have it

-

And instead offers cash as a replacement

That might sound harmless — but it’s not.

Because once that happens, the contract is exposed as a promise that cannot be kept.

And in markets, trust is everything.

Why Silver Matters More Than People Think

Many people believe silver is “just another metal.”

But silver sits in a dangerous position because it is:

-

both a financial asset

-

and a critical industrial material (electronics, energy, tech, defence)

Silver is also traded heavily on COMEX, which is mostly a paper market.

According to Holter’s argument:

-

physical silver prices around the world are already higher than paper prices

-

which suggests the paper market may no longer reflect reality

That gap is the warning sign.

The Bigger Issue: Derivatives

Here’s where things get serious.

Silver contracts are part of a much larger system called derivatives.

A derivative is a financial contract whose value depends on something else:

-

metals

-

currencies

-

interest rates

-

stocks

The global derivatives market is many times larger than the real economy.

Even conservative estimates put it at:

-

several times larger than all physical assets on Earth combined

That’s why Warren Buffett famously called derivatives:

“Weapons of mass financial destruction.”

Why?

Because if one part breaks, confidence spreads fast.

Why Silver Could Be the Trigger

Holter’s argument is not that silver is the biggest market.

It’s that silver is the weakest link.

If silver contracts fail to deliver:

-

Traders ask: “If silver failed, what about gold?”

-

Then: “What about oil? Wheat? Copper?”

-

Then: “What about interest rates and currencies?”

At that point, people stop trusting contracts.

And when contracts lose trust, markets freeze.

Not because prices fall —

but because no one knows what is real anymore.

The Japanese Carry Trade Connection (Simple Version)

Holter also mentions something called the Japanese carry trade.

In simple terms:

-

Japan had near-zero interest rates for years

-

Big players borrowed cheap yen

-

They used that money to buy assets all over the world

That money helped:

-

prop up stocks

-

support bonds

-

and even suppress gold and silver prices through paper selling

Now that Japanese interest rates are rising:

-

the carry trade is unwinding

-

money is being pulled back

-

and positions must be closed

Closing a short position in silver means:

👉 buying silver

That adds upward pressure at the worst possible time — when physical supply is already tight.

What Happens If Confidence Breaks?

This is the real danger.

If markets believe contracts can’t be trusted:

-

prices stop meaning what they used to

-

liquidity disappears

-

governments and central banks step in with emergency measures

Historically, this leads to:

-

forced cash settlements

-

rule changes

-

capital controls

-

and sometimes digital or programmable money systems ( – I believe the asset-backed crypto/tokenised Quantum Financial System will replace the current fiat systems.)

Not because leaders want chaos — but because systems try to survive.

What This Means for Regular People

This is important:

You do not need to agree with every claim to understand the risk.

The risk is not silver hitting a certain price.

The risk is:

-

promises failing

-

trust breaking

-

and people realising too late that they were relying on systems they didn’t understand

When that happens:

-

rules change quickly

-

access becomes restricted

-

and calm decision-making becomes rare

Why This Is an Identity Problem, Not Just a Money Problem

When systems shake, most people ask:

“What should I buy?”

But the deeper question is:

“Who am I when the old rules stop working?”

Because panic doesn’t come from loss —

it comes from lack of orientation.

This is why moments like this often lead to:

-

fear-based decisions

-

chasing narratives

-

and copying louder voices

That’s how people get hurt — financially and emotionally.

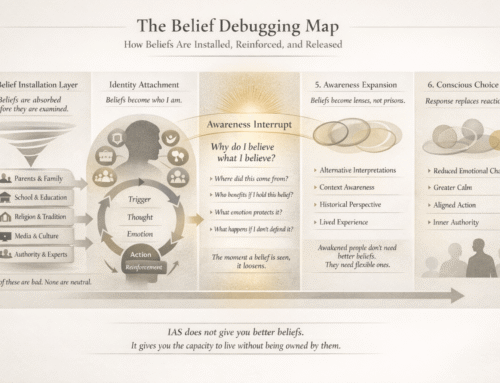

A Quiet Bridge to IAS (Identity Awakening System)

This is where the Identity Awakening System (IAS) fits in — not as a financial solution, but as a grounding one.

IAS exists to help people:

-

slow down

-

reconnect with their own inner reference point

-

and act from clarity instead of pressure

Not:

-

“What do I buy?”

But: -

“What do I trust?”

-

“What still feels true?”

-

“What kind of person do I choose to be during uncertainty?”

When clarity comes first, creation — and decisions — become calmer and wiser.

You can explore IAS here, with no urgency and no promises:

👉 https://immachines.groovepages.com/identity/

Final Thought

Whether silver delivers or not is still unknown.

But this much is clear:

Systems built on confidence don’t break loudly.

They crack quietly — until they don’t.

Understanding that ahead of time doesn’t make you fearful.

It makes you early.

And in times like these, being early — and grounded — matters more than being right.