If you think of silver as just another line on a price chart, you’re missing the point.

The big idea behind this post is simple:

We’re moving into a world where silver isn’t just “an investment” — it becomes infrastructure.

And there may not be enough to go round.

Let’s break it down in plain English.

1. Silver is not software — you can’t just “spin up more”

We’re used to digital things:

-

Need more storage? Click a button.

-

Need another copy of a file? Ctrl + C, Ctrl + V.

Silver does not work like that.

To bring new silver to market, you need:

-

To find it in the ground

-

Environmental studies and permits

-

Financing and approvals

-

Building the mine

-

Digging ore

-

Refining the metal

That’s 5–10 years, not “next quarter”.

Meanwhile, for the last 7+ years, the world has been using more silver than it produces each year. That’s called a structural deficit — and it’s not a small one.

Every year, the above-ground “spare” silver pile gets smaller.

2. Why demand is exploding (and won’t go backwards)

Silver isn’t just for coins and jewellery anymore.

It’s baked into:

-

Solar panels

-

Electric vehicles

-

Batteries

-

5G + electronics

-

Medical devices and sterilisation

-

Sensors, chips, grids, AI data centres

Most of that silver:

-

Gets used once

-

Ends up in landfills, complex products, or waste streams

-

Is too expensive to recycle at scale

So:

Every year, a big chunk of silver disappears from the system… permanently.

At the same time, we’re trying to electrify everything:

-

More EVs

-

More renewables

-

More tech per person

Demand up.

Supply locked behind geology and time.

That’s the setup.

3. Why this isn’t “just another cycle”

In “normal” markets, higher prices trigger more supply.

With silver, there’s a catch:

-

Most silver is mined as a by-product of other metals (zinc, lead, copper, gold).

-

So even if silver skyrockets, miners don’t automatically rush to dig more silver.

They respond to prices of the main metal they’re mining.

That means:

-

Supply doesn’t react quickly to price.

-

Shortages don’t magically fix themselves.

-

The gap continues… until reality forces a big, ugly repricing.

Think: less “smooth trend”, more “brick wall”.

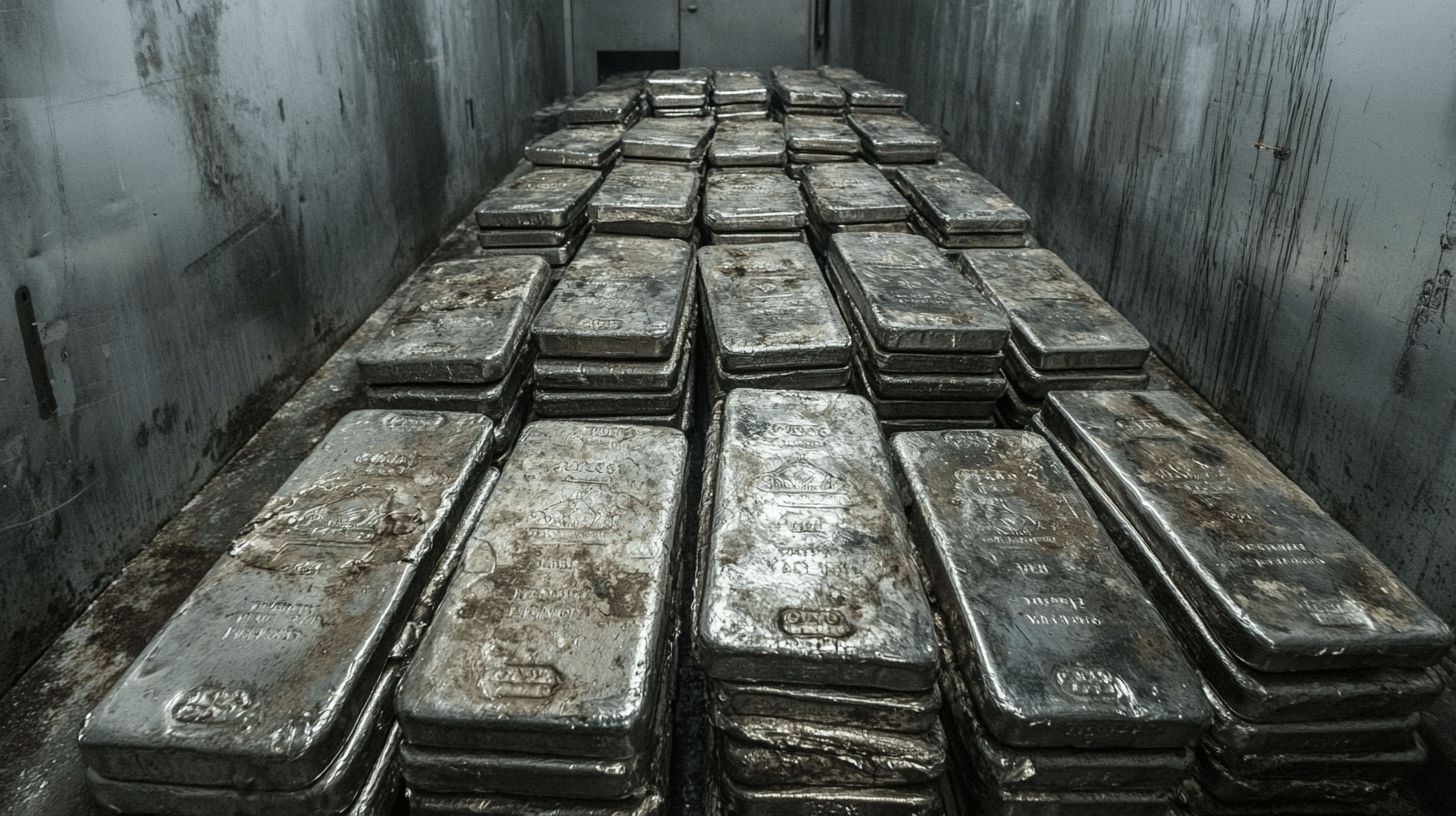

4. The silver deficit: what it really means

For several years in a row:

-

We’ve used more silver than we’ve produced.

-

The shortfall came from existing stockpiles and inventories.

-

Those stockpiles have been quietly shrinking.

That’s like having a savings account you keep dipping into:

-

The first year: “We’re fine.”

-

The third year: “Bit tight, but OK.”

-

Year seven: “…Oh.”

At some point, the market hits a phase where the question shifts from:

“What’s the price?”

to

“Can I even get any?”

We’re not there yet… but the talk argues we’re moving towards that “unobtainable” phase.

5. Paper silver vs real silver (why this matters)

A big part of the silver market exists as paper claims:

-

Futures contracts

-

ETFs and pooled accounts

-

“Unallocated” holdings

These all assume there’s enough physical metal somewhere to back them.

The problem:

-

Years of deficits suggest that there may be more paper silver than real silver.

-

If too many people suddenly ask for real delivery instead of cash:

-

Delays happen

-

Some can’t be fulfilled immediately

-

Confidence cracks

-

If/when that happens, you get:

-

One price for paper silver

-

A much higher price for real, physical silver

That’s called decoupling – and it usually isn’t gentle.

6. Why silver is uniquely positioned

Silver has a weird double life:

-

Monetary metal

-

Historically used as money for thousands of years

-

A store of value when currencies are being debased

-

-

Industrial metal

-

Essential for the modern grid, tech, and medical systems

-

Actually consumed, not just stored

-

Gold is mostly held in vaults.

Silver is mostly used up.

So in this view, silver doesn’t just go up because:

-

Currencies weaken

-

Investors get excited

It also goes up because:

-

The industrial world needs it to function

Two separate engines pushing the same asset.

7. Phase shifts: from “ignored” to “unobtainable”

The speaker breaks silver’s journey into phases:

-

Undermined – Nobody cares, it’s treated like any other commodity.

-

Undervalued – Price doesn’t reflect how critical it is.

-

Unchained – Long-term resistance breaks; price finally wakes up.

-

Unstoppable – Scarcity feeds on itself (people hoard it, inventory disappears).

-

Unobtainable – You can’t easily get physical metal anymore.

-

Unaffordable – Industrial users outbid everyone else just to stay in business.

The argument:

We’re somewhere around early stage 3 right now.

8. What this means for ordinary people

The talk isn’t saying:

-

“Sell everything and go 100% silver.”

It’s saying:

If we’re entering a decade where:

-

Currencies are under pressure

-

Debt is exploding

-

Real resources are scarce

-

And silver is both money and infrastructure…

…then it might be unwise to ignore it completely.

Key principles:

-

Think in purchasing power, not just currency.

It’s not about how many pounds/dollars you have – it’s what they actually buy. -

Scarce, real things beat infinite digital promises.

You can print currency. You can’t print silver. -

Early beats obvious.

By the time the mainstream fully “gets” the story, the easy asymmetric upside is gone.

(Obvious but important note: this isn’t personalised financial advice. It’s a lens. You still need to consider your own situation, risk tolerance, and talk to an actual financial adviser if you’re making big moves.)

9. How this connects to the IMMachines audience

If you’re an IMMachines reader, you’re not just trying to “protect money”.

You’re trying to:

-

Build sovereignty

-

Create income streams you control

-

Step out of blind dependence on systems that are creaking

Silver is one piece of a bigger picture:

-

Skills you can sell in any economy

-

Digital assets that pay you (courses, GPTs, books, systems)

-

Real-world assets (like silver) that don’t vanish when markets wobble

-

Community and networks, so you’re not facing it all alone

-

Identity work, so you respond with clarity, not fear

This isn’t about doom.

It’s about being early, awake and positioned while everyone else still thinks “things will just go back to normal”.