Have you ever noticed this:

-

Every country is in debt.

-

The numbers are insane — trillions and trillions.

-

And somehow… the debt never gets paid off.

That’s not an accident.

This video explains why the system works like that — and why it was never designed to let us escape.

Let’s strip it right down.

1. The Weird Question Nobody Asks

We’re told things like:

-

“The US owes $38 trillion.”

-

“The world owes over $300 trillion.”

OK… but to who?

When you follow the chain all the way back, you discover:

The world owes money… to itself.

Humanity owes itself.

So why does it feel like we’re all broke while someone else is always getting richer?

Because of how the debt machine was built.

2. The Old World: Debt Used to End

Before this system, debt was simple:

-

A king borrowed gold from rich people.

-

He paid it back with interest.

-

If he couldn’t pay, he defaulted (failed).

-

The lender lost money.

-

Everyone moved on.

Debt:

-

had a start,

-

a middle,

-

an end.

Painful sometimes, but not permanent.

Then a new idea appeared that changed everything.

3. Level 1 – William Paterson: Debt That Never Ends

In 1694, England needed money for war.

Nobody trusted the king — he’d defaulted before.

A man called William Paterson came up with a new deal:

“We’ll lend you a huge amount.

You never repay the original.

You just pay interest forever.”

To handle this, they created the Bank of England.

Key twist:

-

The loan became permanent.

-

The government paid interest from taxes (from the people).

-

The rich lenders got a safe income forever.

Then Paterson added something huge:

The bank could create paper money backed by government debt.

So:

-

Government IOUs (debt) = the base of the money system

-

The more government borrows → the more money can be created

From that point on:

Debt became money.

And if you try to pay back the debt?

You shrink the money supply the system is built on.

So:

-

Government debt is never meant to disappear.

-

It’s meant to roll forever.

That’s the first lock in the trap.

4. Level 2 – Rothschild: Make the Trap Global

A century later, Nathan Rothschild built a banking network across Europe.

His innovation:

-

Turn government debt into tradable products (bonds).

-

Sell them to investors all across Europe.

-

Now everyone owns everyone’s debt.

So if Britain defaulted:

-

It wouldn’t just hurt Britain.

-

It would hit French investors, German banks, Austrian nobles, etc.

Default became too dangerous.

So what do governments do?

-

They don’t default.

-

They borrow more to pay the old interest.

Debt is now:

-

Permanent

-

Global

-

Too connected to fail

That’s lock number two.

5. Level 3 – J.P. Morgan & the Fed: Make Debt Infinite

Jump to the USA in the early 1900s.

After a big crisis in 1907, bankers met in secret and designed the Federal Reserve (the US central bank).

The key rule:

The Fed can create money to buy government debt.

So whenever the US government wants more money:

-

It creates bonds (IOUs).

-

The Fed creates new money and buys them.

-

That money goes into the economy.

-

The debt sits on the Fed’s balance sheet.

-

Taxpayers pay interest on it. Forever.

Result:

-

There is always a buyer for government debt.

-

There is effectively no limit to how deep into debt the government can go.

Debt is now:

-

Permanent

-

Global

-

Infinite

Lock number three.

6. Level 4 – Volcker & the IMF: Make It Inescapable

In the 1980s, many poorer countries had borrowed lots of dollars.

Then US interest rates were pushed very high to fight inflation.

Their repayments exploded.

Countries like Mexico, Brazil, Argentina were about to default.

Instead of letting the system reset, something else happened:

-

The IMF and others stepped in with “bailout loans”.

-

These weren’t to “help the people”.

-

They were to make sure the countries kept paying the banks.

The price:

-

austerity (spending cuts)

-

selling national assets

-

losing control of their own policies

Default wasn’t allowed.

Debt was recycled, stretched out, made permanent.

This copied system was then used worldwide.

Debt is now:

-

Permanent

-

Global

-

Infinite

-

Inescapable

Lock number four.

7. So What Does This Mean for Ordinary People?

Let’s simplify.

How money is created now

-

Governments borrow money by issuing bonds.

-

Central banks create new money to buy those bonds.

-

That new money flows into the economy.

-

Taxpayers pay interest on that debt every year.

-

The debt is never actually paid off. It just keeps growing.

So every year:

-

part of your taxes

-

part of your work

-

part of your time and energy

…is quietly sent as interest to huge financial institutions:

-

big banks

-

pension giants

-

asset managers

-

funds like BlackRock, Vanguard, etc.

It’s not called “tribute” or “rent on your life”.

It’s called “debt service”.

But functionally?

It’s a built-in, automatic, never-ending wealth transfer

from workers → owners of debt.

That’s the trap.

8. Why Can’t We Just “Pay It Off”?

This is the brutal part.

Because our money system = debt-based, if countries tried to:

-

pay off their debt

-

or even shrink it strongly

…they would also destroy the money that was created from that debt.

If all governments paid off their debts:

-

the global money supply would shrink massively

-

trade would freeze

-

banks & pensions would crash

So:

The system doesn’t want the debt to be paid off.

It literally can’t survive if that happens.

So the only “solution” inside this system is:

-

more debt

-

forever

That’s why:

-

every crisis is met with more borrowing

-

every recession is “fixed” with more stimulus

-

wars and emergencies are excuses for more debt

The machine is doing exactly what it was designed to do.

9. Why This Matters for Awakening & New Earth

Once you see this, a few things become obvious:

-

You were born into a rigged game.

-

The goal of the system is continuity, not fairness.

-

You are expected to:

-

work

-

pay tax

-

fund interest

-

repeat

-

…for life.

That’s why it feels like:

-

saving is hard

-

houses are out of reach

-

you’re always “behind”

-

each generation feels poorer

It’s not because you’re lazy.

It’s because the system is built to pull value upwards constantly.

So what happens when enough people wake up to this?

The same thing that happens when fake silver pricing blows up:

Trust cracks.

Once people stop believing in the engine,

they start asking:

“Why are we still running this thing?”

That’s when a new financial system becomes not just “interesting”

but necessary.

10. What a New System Needs to Look Like (Big Picture)

There are lots of models being discussed (gold/asset-backed systems, local currencies, crypto, QFS-style ideas, etc.), but in simple terms a healthier system would:

-

Not rely on endless debt to create money

-

Stop automatic, invisible wealth siphoning from workers to mega-institutions

-

Let debt end (real default, real reset, real clearing)

-

Connect money to real value (production, land, energy, skills, goods)

-

Reward creation, not just ownership of old paper

-

Allow countries to restructure without being permanently trapped

In other words:

A system built around real value,

not permanent obligations.

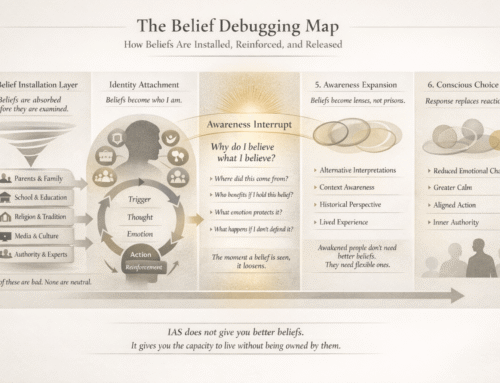

11. What This Means for IMMachines Readers

You can’t personally rebuild the global system (yet 😏).

But you can change what game you play.

A. Stop thinking like a debtor, start thinking like a creator

The old system wants you to:

-

trade time for money

-

take on debt

-

stay dependent

A New Earth mindset is:

-

build assets, not just income

-

create things that help people wake up and become freer

-

use AI and the internet to create sovereign income streams

B. Move closer to real value

Ask yourself:

-

Do I own or build anything that’s real?

-

Knowledge, skills, health, relationships, digital products, land, metals, tools?

Can I:

-

help others escape mental, financial, or spiritual traps?

-

trade value without needing giant institutions?

That’s what your whole IMMachines ecosystem is about:

Helping mid-life creators become sovereign nodes

in a system that wants them dependent.

C. Prepare for the shift

As more people see the trap:

-

the current system will become more chaotic

-

the pressure to build something new will increase

-

those who’ve already been creating, learning and building systems

will be the guides others look to

That’s my reader.

You’re not just “consumers” of content.

You’re the early builders of the next economy.