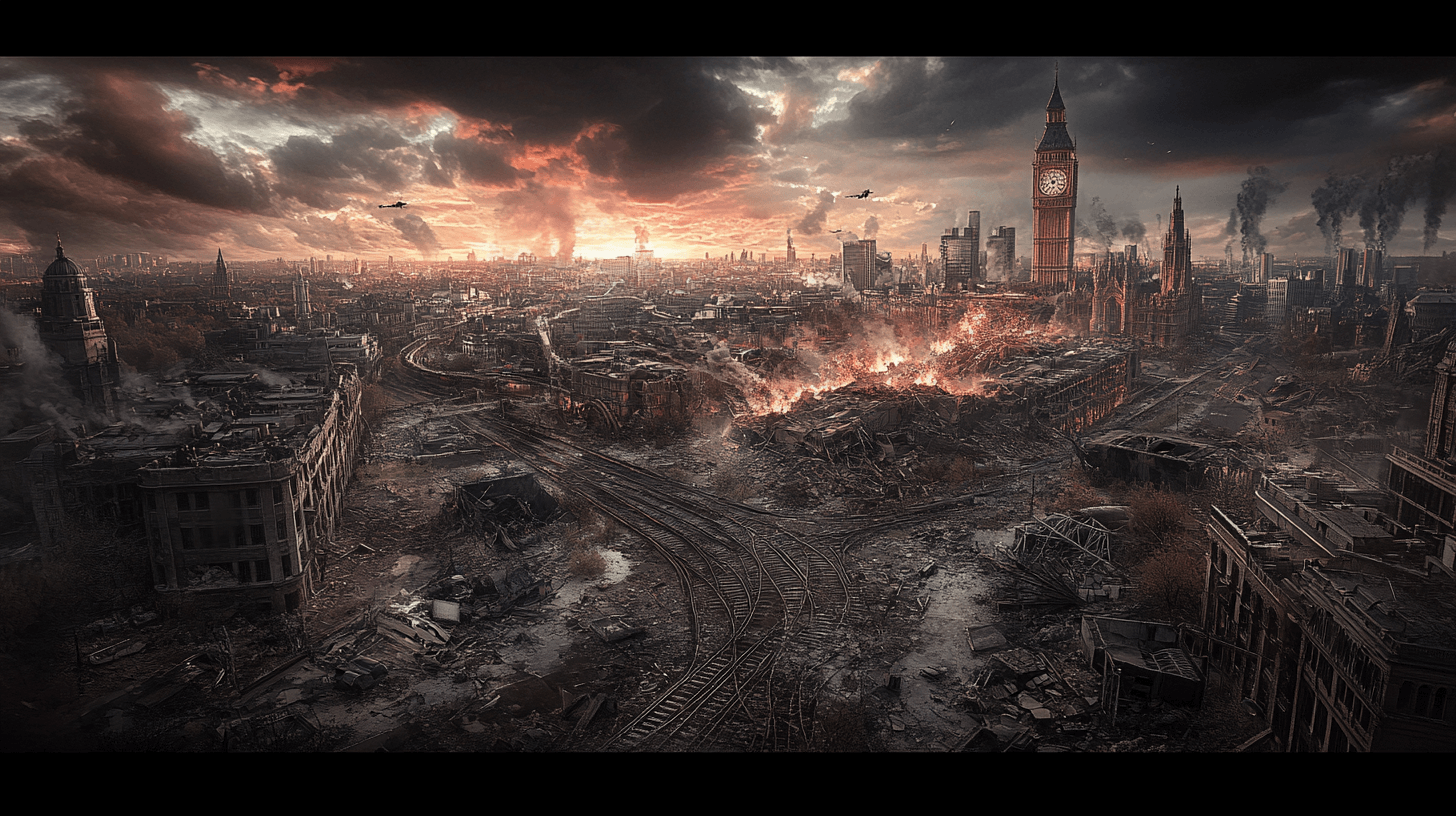

Civilisations Don’t Explode… They Sink Quietly

When we picture collapse, we imagine something dramatic: riots, burning buildings, a single “big event” where everything breaks at once.

In reality, civilisations usually crumble in slow motion.

They decline through:

-

A slightly higher tax here

-

A bit more inflation there

-

Trains getting a little worse

-

Hospitals taking a bit longer

-

Wages staying flat while costs rise

Each change is small enough to tolerate.

Then one day you look up and realise:

“This new normal isn’t normal at all. It’s slow collapse.”

That’s the core message of the video: the UK today is following a very old, very predictable pattern that has already taken down Spain, the British Empire itself, and the Soviet Union.

And if we’re building businesses and lives in this environment, we need to understand the pattern we’re standing inside.

The Collapse Pattern: Same Movie, Different Cast

The video walks through 500+ years of history and shows the same sequence repeating across empires:

-

Overextension – taking on more than the system can sustain

-

Currency games – debasing money, printing, financial tricks

-

Debt spirals – borrowing just to stay afloat

-

Collapse in real production – importing everything, making very little

-

Social fracture – people turning on each other, brain drain, talent leaving

-

Loss of reserve currency / credibility

-

Sudden “shock” collapse (which was really decades in the making)

Spain did it with New World silver.

Britain did it with colonial extraction and war.

The Soviet Union did it with fake productivity and oil.

Different ideologies.

Same math.

Now we’re watching the UK (and the US) run the same code.

What’s Actually Going Wrong in the UK?

Let’s translate the big narrative into simple, real-world terms you can feel in daily life.

1. The Economy Isn’t Really Growing

The UK economy has barely grown in real terms since before the 2008 crisis. Wages, once you account for inflation, have been flat or falling for many workers for well over a decade, while core costs like housing and energy have risen. That’s not “a dip”. That’s a structural stall.

When the pie stops growing, people don’t feel “OK”. They feel squeezed.

2. We Stopped Building – And Started Extracting

Instead of fixing the underlying engine (productivity and production), the UK has done what declining powers always do: extraction.

-

Higher overall tax burden

-

More pressure on the working and middle classes

-

More borrowing instead of real investment

-

Endless short-term fixes, almost no long-term rebuilding

It’s like running a business that never upgrades equipment, never trains staff, never improves its product – and then wonders why it’s always short of cash.

3. The North Sea & The City: Two Massive Strategic Errors

The video calls out two huge “curses” that warped the UK’s economy:

-

The resource curse (North Sea oil):

Instead of using oil wealth to build a sovereign fund and invest in the future, we mostly spent it to smooth over problems, subsidise consumption, and mask the decline of industry. -

The finance curse (The City of London):

The UK doubled down on finance and global money flows while letting real-world production hollow out.

Capital piled into property, derivatives, and paper assets – not factories, infrastructure or energy.

On paper, everything looked rich.

On the ground, a lot of the country was quietly decaying.

4. Demographics and Infrastructure: The Uncomfortable Math

Two more structural issues:

-

Birth rate: Fewer children being born means an ageing population, fewer workers, and more pressure on public services over time.

-

Infrastructure: Leaking water systems, under-maintained hospitals, creaking rail, fragile energy grid – all symptoms of years of underinvestment in the boring, essential stuff.

When you put this together, you get a system that:

-

Can’t grow reliably

-

Can’t keep up with its promises

-

Can’t easily absorb shocks

That’s what “stage 6” of an empire looks like in practice.

The Doom Loop: Work More, Keep Less, Give Up

One of the nastiest dynamics described in the video is the “doom loop” of incentives”.

-

Taxes go up and benefits are tapered in strange ways.

-

Some people face extremely high effective marginal rates once you combine tax, NI, benefit tapering, and student loan repayments.

-

The message people feel is: “Work harder if you want, but we’ll take most of the extra.”

When systems send that message, rational people do the rational thing:

They stop pushing.

They:

-

Decline promotions

-

Cut hours

-

Delay starting businesses

-

Delay skills upgrades

-

Dream less about the future, and focus on surviving the present

When a whole population starts doing that, the national engine slows even further – and government responds with… more extraction.

Loop complete.

Talent Leaving: The Final Stage of Decline

The most dangerous signal isn’t just bad numbers. It’s who leaves.

When:

-

Doctors

-

Engineers

-

Builders

-

Young families

-

Ambitious creators

start looking at other countries as a better bet, the decline moves from “maybe fixable” to “self-reinforcing”.

You don’t just lose workers.

You lose problem-solvers.

You lose the people who could rebuild.

That’s happening in the UK already – more quietly than dramatically, but steadily.

Is Collapse Guaranteed? No. But Drift Is Deadly.

The video’s harsh but honest point:

-

This isn’t destiny. It’s design.

-

Systems collapse when we keep feeding them the same inputs and expecting a different output.

Collapse is just the logical result of:

-

Under-investing in production, energy, and infrastructure

-

Over-relying on debt and financial tricks

-

Punishing productive effort

-

Ignoring boring, long-term work in favour of short-term narrative and political optics

The UK could re-engineer its system:

-

Rebuild real production and engineering

-

Fix energy properly (cheap, abundant, reliable)

-

Incentivise work, creation, and innovation instead of squeezing them

-

Upgrade infrastructure in decades-long cycles, not PR cycles

-

Make competence and delivery the standard in public institutions

But that requires something almost no collapsing empire has: the humility to admit it’s collapsing before it hits the wall.

What This Means For You As a Creator

Let’s bring it back to your world as an IMMachines reader – a creator, coach, consultant, or solopreneur trying to build something meaningful in the middle of all this.

You can’t personally rebuild the national grid.

But you can choose how you position yourself inside a system that’s drifting:

-

Don’t confuse the system’s story with your reality.

Politicians say “growth, opportunity, levelling up.”

Your day-to-day reality says: higher costs, flat wages, more friction.

Believe the data you live, not the slogan. -

Shift from employee thinking to asset-thinking.

The old model: one employer, one income, hope the system stays stable.

The new model: build assets – skills, audience, IP, systems, digital products, networks. -

Diversify across borders and systems where possible.

-

Client base in multiple countries

-

Revenue in multiple currencies

-

A business that can operate online, not just locally

-

-

Use decay as a signal to build, not to freeze.

When systems deteriorate:-

People need new ways to earn

-

Businesses need leaner solutions

-

Individuals search for new paths, identities, and income streams

That’s exactly where your offers, frameworks, and guidance live.

-

-

Become “antifragile” at a personal level.

-

Lower personal debt

-

Keep your fixed costs sane

-

Build cash buffers and flexible income streams

-

Invest in learning how systems actually work – money, tech, geopolitics, energy

-

The national story may be one of decline.

Your personal story doesn’t have to be.