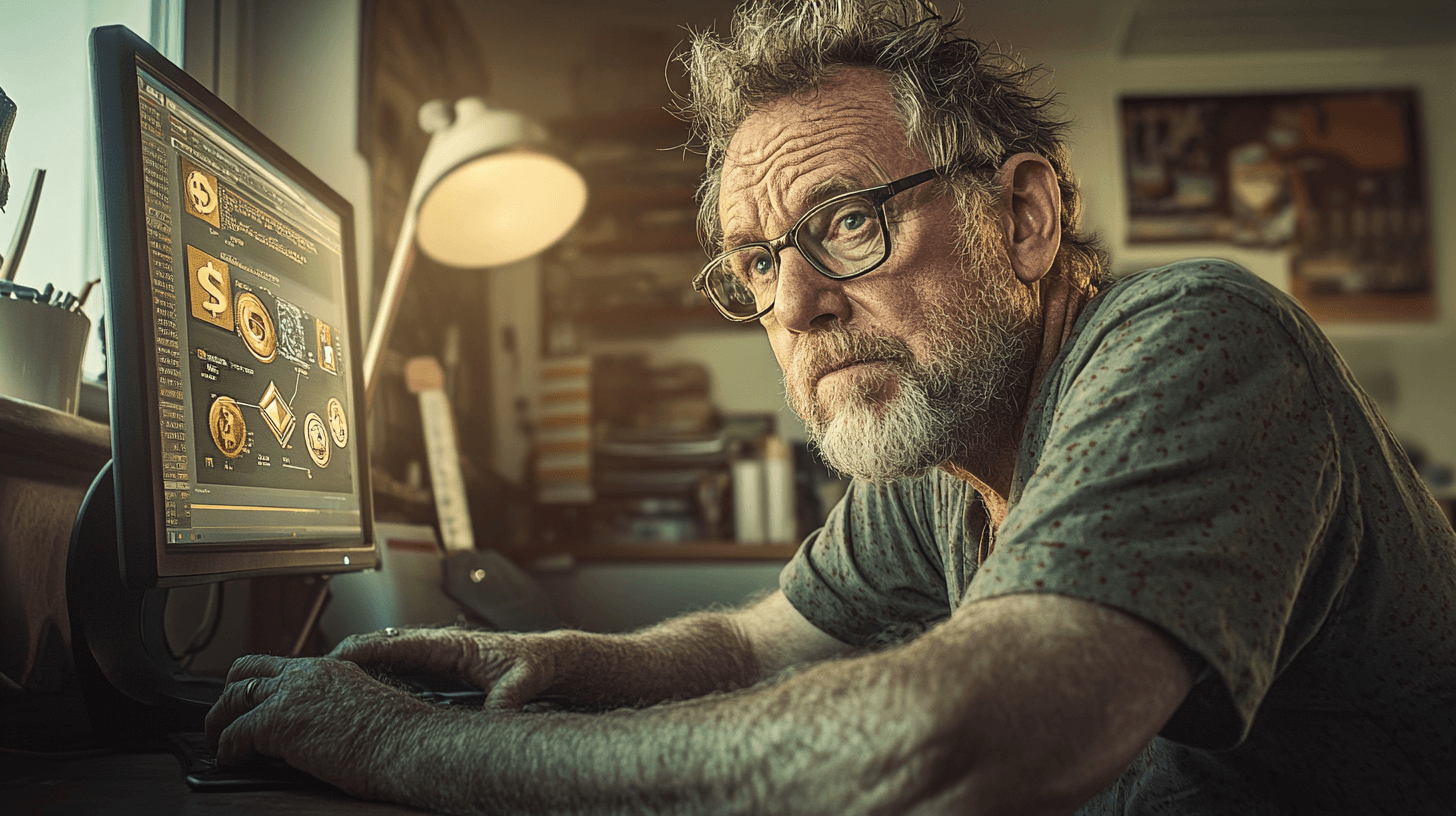

Six months ago, I lost $4,000 in a crypto scam through a Telegram channel that promised “guaranteed returns.”

It wasn’t just a financial loss — it was a trust fracture.

I remember that sickening feeling: one moment of blind optimism, a few clicks too fast, and the money vanished. No customer support, no recourse, just digital silence. The real sickening part is that I should have known better given my experience in banking! It felt like a scam – the ‘guaranteed’ returns too high. I got in based on fake testimonials and at the lowest investment I could make to test it out. It felt risky and it was – I ignored my gut feeling – fatal! I tried to get the channel banned on Telegram but Telegram did nothing. I am pursuing a recovery process but I have written off the money to experience.

Crypto intrigues me greatly and I confess little understanding so I step into the risks in order to learn more because it seems to me that the future financial system will be on an asset-backed blockchain called the Quantum Financial System that ironically will make fraud difficult as the ledger will trace all transactions (i.e. fraud investigators can ‘follow the money’.)

That experience has taught me to be more cautious and diligent.

It reminded me that discernment is a spiritual muscle — one you strengthen through pain.

So when I decided to step back into crypto, I promised myself two things:

-

I’d move slowly.

-

I’d make every decision consciously.

The Return — Guided by Logic, Grounded in Flow

Fast-forward to this week.

I decided to try again — but with grounded energy, not desperation.

I began with a simple intention: to understand the system from the inside.

I wasn’t looking to “get rich.” I wanted to learn how digital assets interact with energy, trust, and the emerging financial landscape we’re moving toward.

I originally tried to transfer funds to Binance via Barclays, but the transaction was blocked. It felt like another door closing.

So I asked AI — specifically, ChatGPT — what to do.

It advised me to use Lloyds Bank and a regulated UK platform like eToro.

That single conversation saved me from another potential pitfall.

The Three Coins That Chose Me

My first official purchases were:

-

Litecoin (LTC) — recommended by a wealthy entrepreneur tokenising property investments in Hawaii. I loved the idea of real assets meeting digital tokens — tangible meets transcendent.

-

XRP (Ripple) and XLM (Stellar Lumens) — both are core to what many call the Quantum Financial System (QFS), a more transparent, asset-backed, and interoperable digital economy. Whether that system is already operational or still emerging, these two coins represent the bridge between old and new money.

Each purchase carried a unique energy:

-

Litecoin felt entrepreneurial.

-

XRP felt institutional — the old world adapting.

-

XLM felt humanitarian — a currency of connection. I have invested in some physical silver and my understanding is that XLM will be backed by Silver so this feels right to me. I believe silver is under-priced as the price in relation to Gold and it’s historical ratio of 15:1 is vastly out of kilter due to paper contracts where traders are dealing in paper without the ability to buy physical delivery for all contracts in the market. At some point delivery will be required and then the price manipulation will collapse – we will see. Anyway physical precious metals feels safer than fiat currency at the moment.

What I Felt Clicking “Buy”

As I hit “Confirm Purchase” on eToro, I noticed something subtle — my body tightened slightly, then relaxed.

That moment showed me how risk lives in the nervous system. As a former bank manager I felt the same whenever I lent money to a customer! Much of my success in banking was based on gut-feeling as, although I tried hard to get as much information as possible to back my lending decision, often it was impossible to get everything you wanted at a price that reflected the risk so this is where judgment was required. Over a lengthy period of time I built a solid portfolio of businesses.

Crypto doesn’t just test your portfolio; it tests your presence.

The charts reflect not just market psychology but your personal psychology.

This time, I wasn’t buying hype. I was buying alignment — curiosity without attachment.

The £1,000 wasn’t an investment in coins; it was an investment in consciousness.

Lessons From the Scam — and From Redemption

The Telegram scam had been a teacher dressed as a thief.

It forced me to develop filters — technological, emotional, and energetic.

Here’s what changed in me:

-

No more blind trust. Every opportunity gets verified. Every claim gets checked.

-

No more FOMO. Missing out is fine. Losing trust in myself isn’t.

-

No more borrowed energy. Only use funds you own, not funds you owe.

-

No more chasing promises. If it sounds like salvation, it’s probably greed or temptation.

Crypto, like business, rewards patience and clarity — not panic or greed. Also, it always makes sense to me to spread risk by having a variety of assets.

What the Quantum Financial Shift Really Means (Energetically)

The term Quantum Financial System gets thrown around a lot online.

Some treat it like prophecy; others treat it like myth.

But here’s the truth I feel:

Whether or not the “QFS” manifests exactly as predicted, we are moving into a new era where money is becoming transparent, tokenised, and trust-based.

This is less about technology and more about frequency.

Money is energy.

Energy flows where trust grows.

When we remove middlemen, we remove friction — and that allows value to move more freely between people who create, contribute, and care. The Banks have unfortunately stolen wealth from the people by bringing money into existence through debt and charging interest on a fake asset that has virtually no backing or cost to produce. This compounded by reckless printing and inflation that constantly reduces the purchasing power of the money which is a hidden tax on top of all the other taxes imposed by our corrupt Government.

That’s the spiritual dimension of decentralisation: not rebellion, but reconnection. If Banks like Barclays are stopping funds deposited with them from flowing into crypto then they are frightened about the potential of crypto to reduce their power. However, they are currently using the excuse that crypto is high risk, ignoring the fact that their own fiat system feels even riskier given their systemic abuse of fiat currency.

Crypto as a Mirror of the Creator’s Path

In my work at IMMachines, I teach creators how to build simple, scalable systems that generate value.

Crypto is a mirror of that philosophy.

It’s not about overnight riches. It’s about learning how systems move energy — digital, financial, and emotional.

Buying Litecoin, XRP, and XLM taught me more about flow consciousness than any financial seminar ever could.

Every coin became a metaphor:

-

Litecoin — movement and experimentation.

-

XRP — structure and legitimacy.

-

XLM — generosity and open exchange.

Three energies that every creator needs to balance.

The Mindset Shift

Although prices are volatile, I no longer see crypto as a gamble. I see it as a practice — a feedback loop for self-awareness.

When prices rise, I check for ego.

When prices fall, I check for fear.

When prices stay flat, I practice patience.

The chart becomes a mirror.

The profit becomes irrelevant.

The peace becomes the profit.

Practical Advice for Fellow Solopreneurs

If you’re considering entering the crypto space:

-

Use a regulated UK platform (eToro, Coinbase, or Kraken).

-

Avoid Telegram “gurus.” Wisdom whispers; scams shout.

-

Start small. The education is worth far more than the £1,000.

-

Record your decisions. Turn your learning journey into content.

-

Stay grounded. I will use my small investment to learn more about crypto.

Closing Reflection

My first venture into crypto cost me $4,000.

My second venture earned me something far greater: discernment, trust, and renewed curiosity.

I no longer chase gains. I cultivate flow.

Crypto, like consciousness, rewards those who align with truth — not hype.

It doesn’t just build portfolios.

It builds people.

🧭 Want to Learn How to Turn Risk Into Systems That Serve You?

If you’re a mid-life creator, coach, or consultant ready to turn uncertainty into opportunity, explore:

👉 IMMachines: From Chaos to Clarity GPT — your structured, step-by-step guide to building calm, cash-flowing systems that work as predictably as the blockchain.

Because every system — financial or spiritual — begins with alignment.

Here is a brief summary of Litecoin

✅ What is Litecoin?

-

Litecoin was launched in October 2011 by Charlie Lee (former Google engineer) as one of the earliest alternative cryptocurrencies. investopedia.com+1

-

It’s a peer-to-peer cryptocurrency and open-source software project, released under an MIT/X11 license. en.wikipedia.org+1

-

Often described as the “silver to Bitcoin’s gold” — meaning it’s not trying to upstage Bitcoin, but to complement it with different trade-offs. investopedia.com

⚙️ How it works & what sets it apart

Here are some of the key technical/features that make Litecoin distinctive:

-

Block time: Litecoin generates blocks much faster than Bitcoin — approx every 2.5 minutes, compared to Bitcoin’s ~10 minutes. That means faster transaction confirmations. Kraken+1

-

Supply: Maximum supply of 84 million LTC (versus 21 million BTC). So more coins, spread out. Wikipedia+1

-

Algorithm: Uses the Scrypt proof-of-work algorithm (instead of Bitcoin’s SHA-256) at launch, to make mining less resource-concentrated (in theory). Wikipedia+1

-

Purpose: Designed for faster, lower-fee transactions; conceived as more of a “spendable” coin rather than only a store of value. Fidelity+1

🎯 Why people invest in Litecoin

From your creator/business perspective (and the energy/spiritual angle you like):

-

Liquidity & track record: Because it’s one of the older, well-known cryptocurrencies, it carries a level of “historical credibility” in the crypto world.

-

Transaction speed/use case: If you believe that part of the future is people using crypto for value transfer (not just speculation), Litecoin’s faster block times and lower fees can matter.

-

Complement to broader strategy: Since you already hold LTC, as well as XRP and XLM, LTC might function as a diversified “higher-liquidity leg” in your portfolio (while XLM/XRP might be the “new system infrastructure” leg for you).

-

Narrative fit: For your audience of mid-life creators, holding LTC can embody the idea of bridging old-world stability with new-world innovation — “silver” supporting “gold”, humble but dependable.

⚠️ Risks & caveats

– Not a guarantee of massive upside: While Litecoin has potential, many analysts see it more as a stable alt than a hyper-growth play. For example, one recent article described LTC as “stable payment option with limited growth” compared to newer tokens. Indiatimes

– Competition & relevance: Many newer cryptos aim to solve not just payments but smart contracts, decentralised finance (DeFi), interoperability, etc. LTC’s focus is narrower.

– Mining centralisation & algorithm limitations: The Scrypt algorithm initially promised more accessibility, but ASICs for Scrypt mining emerged, reducing that advantage. investopedia.com+1

– Use-case vs hype mismatch: Some believe Litecoin’s use case (faster payments) is already being challenged by other architectures (Layer2, other chains) so its uniqueness may erode.

🔍 How LTC might fit into your system at IMMachines

Given your business and mindset framework (mid-life creators, solopreneurs, systems thinking, energy flow), here’s how you can frame Litecoin:

-

Teaching asset: Use your LTC holding as a mini-case study for your audience: “Why I chose LTC (among others), what the story is, how I downloaded it into my system.”

-

Risk management module: You’ve already had a scam, so you’re in the perfect position to talk about due diligence with LTC: verifying history, codebase, liquidity, community.

-

Energy metaphor: LTC stands for speed + utility + accessibility. You can tie that into creator energy: “If Bitcoin is the flagship course you build, Litecoin is the quick mini-launch you can spin up while that flagship matures.”

-

System-integration: In your GPT asset ecosystem, you could build a module titled “Portfolio Leg: The Transaction Coin” where LTC is the exemplar coin for “fast, accessible, moderate risk” vs “infrastructure coins” vs “emergent coins”.

📌 Final Thought

Litecoin is far from a flashy moon-rocket token (though it could still rise). But it has staying power, simplicity, and a clear purpose. For someone like you — who values systems, awareness, caution after a loss — LTC makes sense as part of a balanced portfolio of crypto assets.

It aligns with your philosophy: using your owned funds, applying systems not hopes, and treating crypto as education + asset rather than a swing-for-the-fences bet.

𝗖𝗿𝘆𝗽𝘁𝗼 𝗖𝗿𝗮𝘀𝗵 𝗖𝗼𝘂𝗿𝘀𝗲

What Is Cryptocurrency?

Imagine a form of money that isn’t issued by any government, can be sent anywhere in the world in minutes, and is secured by mathematics instead of a central authority. That’s what cryptocurrency is — a digital currency designed to operate without banks or intermediaries.

💡 The Basic Idea

At its core, a cryptocurrency is simply digital money that lives on a blockchain — a shared public record of transactions. Every time someone sends or receives crypto, that transaction is added to this record, which is visible to everyone but cannot be easily changed. Unlike the euros or dollars in your bank account, cryptocurrencies don’t exist as physical coins or notes. They exist as entries on a decentralized ledger, verified by thousands of computers across the world.

🧩 Why It Was Created

The idea took off after the 2008 financial crisis, when trust in banks and central authorities was at a low point. In 2009, someone (or a group) under the pseudonym Satoshi Nakamoto introduced Bitcoin, the first cryptocurrency. The goal: to create a peer-to-peer payment system that allows people to send money directly to one another — without needing a bank to process or approve it.

🔒 How It Works

Cryptocurrencies use cryptography (complex mathematical techniques) to secure transactions and control the creation of new coins. • Each user has a public key (like an account number) and a private key (like a password). • When you send crypto, you sign the transaction digitally using your private key. • The network then confirms that the transaction is valid before adding it to the blockchain. Because everyone on the network can see the blockchain, fraud is extremely difficult — you can’t fake ownership or spend the same coin twice.

🌍 What Makes It Different

• Decentralized: No government or central bank controls it. • Borderless: You can send money globally, 24/7, without intermediaries. • Transparent: Anyone can verify transactions on the blockchain. • Limited Supply: Many cryptocurrencies have a fixed supply (like Bitcoin’s 21 million coins), which makes them scarce — and potentially valuable.

⚖️ The Big Picture

Cryptocurrency represents a new experiment in money and trust. Instead of trusting institutions, you trust the network and the code behind it. While it’s still evolving — and comes with risks — it has opened the door to rethinking how money can work in a digital world.